Beginning to Solve the Problem

Multiple definitions of synthetic identity fraud throughout the industry pose a fundamental problem. The lack of a common definition leads to inconsistent categorization and reporting, making it difficult for the industry to identify and mitigate this type of fraud.

Beginning in fall 2020 and concluding in early 2021, a Federal Reserve-convened focus group of 12 fraud experts set out to help address this problem. The group developed an industry-recommended definition of synthetic identity fraud, as well as outlined identity elements that may be used to create a synthetic identity, common uses of synthetics and the envisioned industry application of the definition – all to help improve awareness, detection, measurement and mitigation.

Defining the Problem of Synthetic Identity Fraud

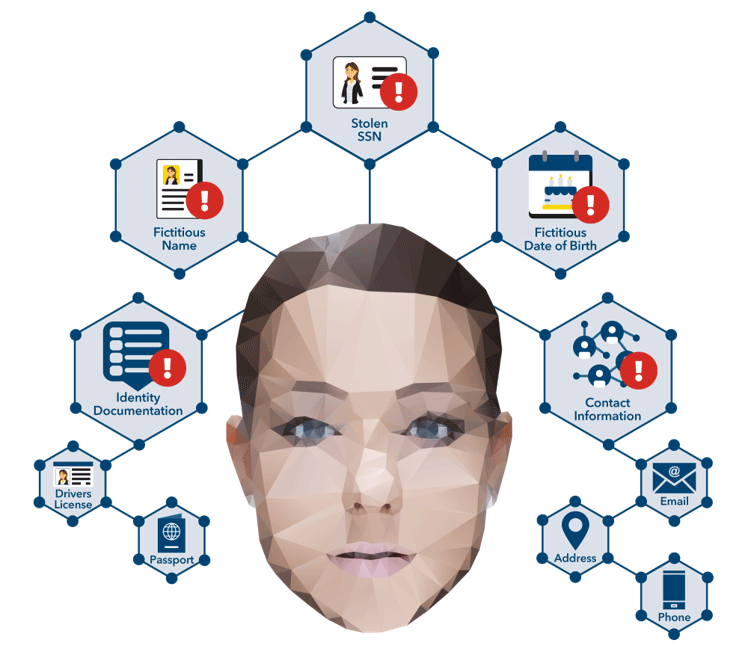

Personally identifiable information (PII) (Off-site) elements that may be used to create a synthetic identity include:

- Primary elements: Identity elements that are, in combination, typically unique to an individual or profile (e.g., name, date of birth, Social Security number and other government-issued identifiers)

- Supplemental elements: Elements that can help substantiate or enhance the validity of an identity but cannot establish an identity by themselves (e.g., mailing or billing address, phone number, email address or digital footprint)

Common Uses of Synthetic Identities

- Credit repair: Used to hide from previous negative credit history or bad debt in order to appear creditworthy.

- Fraud for living: Used to apply for employment or services (e.g., utilities, housing, bank accounts) because an individual is unwilling or unable to do so with existing primary PII elements, with no intent to default on payment.

- Payment default scheme: Used to obtain goods, cash or services with no intent to repay over a period of time.

- Other criminal activity: Used to facilitate a means to an end as part of illegal acts. Note: These illegal acts can be conducted by individuals or groups and can include activities such as avoiding legal responsibilities, money laundering, human and/or narcotics trafficking or terrorist financing.

Applying the Definition Throughout the Industry

The Federal Reserve and focus group members envision that a consistent definition for synthetic identity fraud can be applied throughout the payments industry to:

- Increase industry education and awareness of synthetic identity fraud. For example, the definition can help the industry understand what constitutes synthetic identity fraud and its impact on consumers, organizations and the overall U.S. payment system.

- Foster the ability to speak the same language about synthetic identity fraud. Within organizations, the definition can enable employees to identify and discuss synthetic identity fraud in a consistent manner. Across the industry, the definition offers common language on synthetic identity fraud – and where appropriate, can help improve industry collaboration.

- Enable organizations to identify and classify synthetic identity fraud in a similar manner. Consistent identification and classification of synthetics can prevent miscategorization of losses and provides insights into where losses are occurring. This can help the industry better understand the scope and magnitude of this issue and associated fraud tactics and improve mitigation strategies.

- Help organizations improve synthetic identity fraud modeling. The definition and PII examples can provide potential ways for organizations to increase and improve monitoring of synthetic identities. For example, shifting fraud models from focusing primarily on payment behaviors to the identity itself can help better identify synthetics in financial portfolios. The combination of insights gained from consistent classification and increased monitoring could help organizations improve fraud management within modeling (including detection, mitigation and prevention).

Advancing the Fight Against Fraud

A common definition of synthetic identity fraud is an important step toward more consistent identification and classification of synthetic identity fraud – and can encourage industry conversations about this issue. The application of the definition by industry stakeholders will begin building the foundation in the fight against synthetic identity fraud.

Adoption of this industry-recommended definition is voluntary, and as a result, adoption timing and approaches are likely to vary by organization based on their unique business needs and objectives. Some organizations will adopt the definition earlier than others – and their actions and willingness to share their adoption experiences can encourage others to follow, ultimately resulting in widespread definition adoption.

Explore the Synthetic Identity Fraud Definition Overview (PDF) to learn more about the focus group, the development of this definition and the potential ways the industry may apply it.

The synthetic identity fraud definition was developed by a cross-industry focus group to provide a consistent way to identify and classify this type of fraud across the payments industry. This definition of synthetic identity fraud is not intended to result in any regulatory or reporting requirements, imply any liabilities for fraud loss, or confer any legal status, legal definitions, or legal rights or responsibilities. While use of this definition throughout the industry is encouraged, adoption of the definition is voluntary at the discretion of each individual entity. Absent written consent, this definition may not be used in a manner that suggests the Federal Reserve endorses a third-party product or service.